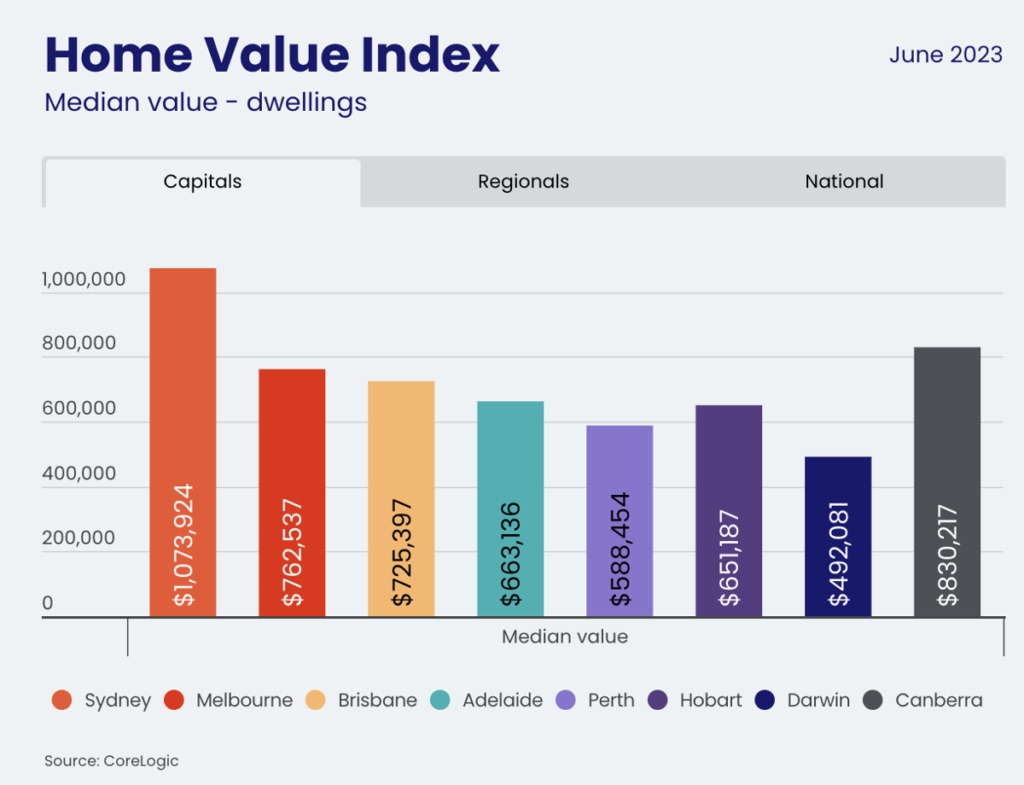

The housing market still lies -6.0% below the heights recorded in April last year. This has risen approximately 3.4% since the low-point in February 2023. Apart from Hobart which recorded -0.3% growth, every other capital city witnessed a rise in values for dwellings in June with Sydney increasing 1.7%. This has increased 6.7% year to date.

There is a notable lack of supply available on the market which has put pressure on housing values. New capital city listings almost touched -10% below the year to date 5-year average and overall inventory more than -25%.

As interest rates rise, there is still an overall uncertain sentiment which is likely to have had an impact on the number of active home buyers. As of July 2023, interest rates remained unchanged from the previous month.

(Source: CoreLogic)

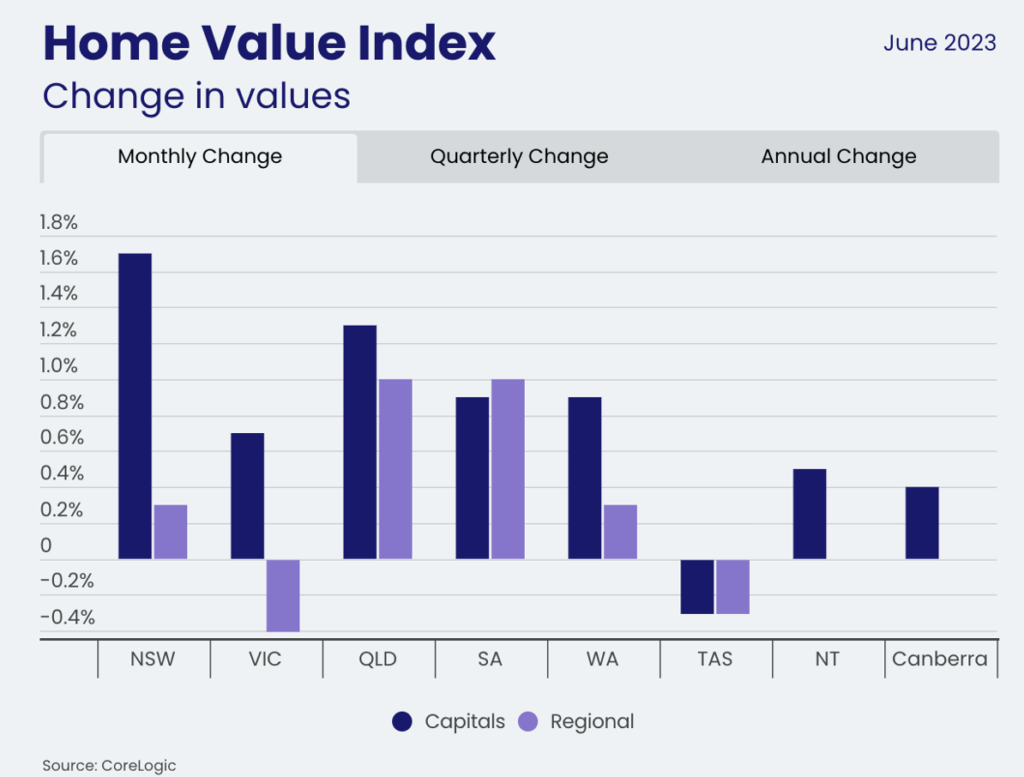

In the regional markets, values have also risen although at a slower rate compared to the capital cities. Overall, the growth in the regional areas have risen for the fourth consecutive month rising 1.2% higher than the low in February. One factor which may have contributed to the slower growth is that of the migration trends having normalised over the past year where people are less looking at regional lifestyles and have returned to the capitals. Regional Victoria recorded a fall of -0.4% which is -1.3% lower over the last 3 months. This is noted where Geelong, Ballarat and Bendigo recorded -0.7%, -0.3% and -0.9% respectively.

(Source: CoreLogic)